I Am Not Leaving AKLTG!

For the record so that the confusion and speculation stops …

AKLTG stands for Adam Khoo Learning Technologies Group. This company is owned by my good friend Adam Khoo. I am not a partner or associate of AKLTG. I am just Adam’s good friend and I happen to be teaching under his roof by his good graces.

Wealth Academy (WA) is a program I co-created with Adam for INVESTORS, high net-worth individuals and those looking for a passive way to make their money work harder. I was also the co-trainer alongside Adam at this workshop from 2007 to 2012. With effect from 26 August 2012, I no longer teach at this workshop. The website and brochure still bear my face because they haven’t updated them yet. My reason for quitting the program I love so much and helped to create is so that I can concentrate on my own program …

Wealth Academy Trader (WAT aka Pattern Trader Tutorial) is my own complete and holistic Finance and Economics program which has been running at AKLTG since late 2006. This program and myself are not leaving AKLTG. It is still AKLTG’s premium program (ie most expensive, lengthy and intensive) and will continue to be hosted by AKLTG because Adam is still my good friend and he believes in my program.

WAT runs several Specialist Workshops exclusively for its graduates only, who wish to further their skills;

- The 8-week Coaching Tutelage for graduates who want to take their learning experiences to the practitioner’s stage

- Hedging with CFDs with Leon Koh for graduates wanting to trade in local markets

- Point and Figure Charting Techniques with Henry Aw Yong (coming soon)

- Option Strategies (coming in 2013)

- Advance Technical Analysis (coming in 2013)

All these Specialist Workshops will be run from AKLTG and are not open to the public.

AKLTG is currently still at Keppel Towers in Tanjong Pagar. However, the lease there will be expiring in 2013 and AKLTG will be moving premises soon. The next training center is expected to be centrally and conveniently located in town (no details as yet) but the administrative offices will be moving to the Paya Lebar/Eunos area (no details yet).

WAT IS NOT MOVING OUT OR LEAVING AKLTG! It is merely following the company where ever it relocates to.

The Pattern Trader Tools website is my own thing and has no relation to AKLTG. This website business is run by two WAT alumni and myself.

The Candlestick Patterns Quick Reference Cards and the Breakout Patterns Quick Reference Cards are my own products and does not belong to AKLTG or Pattern Trader Tools – they are my re-sellers.

And finally …

- I am not dying or suffering from some life-threatening ailment!

- Adam and I did not fight!

- I am very happy with my arrangement at AKLTG

- I am not starting a new program outside of WAT

- I have not/do not/am not/never intended to compete with AKLTG because its my second home

- My book is coming out soon – its just late like everything else in life

- The world will end on 21 December 2012 so sell everything!!

That last one is to test if you have been paying attention to everything I have written. I hope this ends all the misunderstandings, rumors and hear-say.

Thank you.

May Day Food For Thought – 1 May, 2012

INFLATION OR STIMULATION?

Someone asked me why thoughtless lavish spending encourages inflation when it helps to stimulate the economy …

In one small example, buying an apartment you can’t afford then defaulting on the downpayment means that your thoughtless spending just helped to raise the price of properties unrealistically and returning the apartment doesn’t bring the price down. Instead, the developer can now sell that same apartment for a second time but at a higher premium. Your reckless greed just contributed to inflating property prices for the next buyer who really needs a home but cannot afford it now.

I don’t call that stimulating the economy. I call it selfish idiocy and poor financial management at other people’s expense.

In another small example, spending money on things you waste also sends inflation up. Buying more food than you can eat translates into wastage and disposal of wastage costs money. It also encourages the retailer to supply more and thus increases his spending to increase his inventory. Whatever the retailer can’t sell translates into wastage and lost revenue which means he will have to mark up to cover his losses. Such mark ups often stay up and don’t come down and the ripple effect goes backwards through the supply chain.

I don’t call that stimulating the economy. I call it selfish wasteful consumption with no regard for others who can’t afford the consequences of your gluttony.

In one last small example, buying a car you don’t need fuels the need to import more petroleum which in turn (in its own supply chain) raises the price of fuel. More cars also means more congestion which translates into higher ERP rates. Parking rates also increase and these rate hikes never come down.

To meet the needs of the demand by those who can’t afford it, car suppliers ship in more cars in anticipation of a high take up rate. When their cars can’t move, they can’t lower the price of the car as they have to factor in shipping costs, exchange rates and storage expenses. Cost of maintaining the unsold cars also help keep prices up.

Now do we even need to explore the consequences of the price of the COE?

I don’t call that stimulating the economy. I call it face pride and ego in spending money you don’t have for something you don’t really need only to impress those who don’t really care because someone else is always gong to have a bigger, better, faster and more expensive car than you. If you really need an expensive car to impress someone, then that someone is really not worth the sacrifice.

Then someone asked what we can do to make things better.

There is a lot that we can all do as a collective effort to control and even bring down inflation.

We can stop spending lavishly with money we don’t have! This goes back to the thoughtlessness I was referring to in my last posting “Weekend Food For Though 28 April 2012; ‘Just How Do Singaporeans Live?’“.

Lots of people here are heavily leveraged on their credit cards and spending beyond their means with no real solution to paying off all their debts. Others are over-leveraged on loans based on their current income capability instead of realistically looking at their long-term affordability even factoring in bad times.

We’re spending money we don’t have on things we don’t really need. We’re entertaining ourselves and making ourselves happy today without care for tomorrow. All this unnecessary lavish spending only encourages inflation.

There is a fine line between stimulating the economy with necessary spending and fueling inflation with wastage and unnecessary spending. This is called Consumer Sentiment. There are so many other reports that track consumer’s habits to tell us the state of consumer affairs; consumer spending versus consumer income, discretionary spending, consumer credit, inventory reports, services PMI, etc. All these reports are weighed and measured to give us other data like CPI and PPI and other PMI reports.

When you spend, you contribute to these statistics which obviously translate into stimulation or inflation. Singapore is no longer in need of stimulation. It is bloated and inflated with a credit bubble. When this bubble pops, it will be messy, very messy and a lot of people are going to get burnt. It happened in 2008, 2001, 1997, 1987, 1874 and many other times in history all around the world. Our problem is that it is happening more frequently now than any other time in post-war history.

The last time we had such a tight accumulation of bubbles and pops was in the early 1900s. It ended with the great equalization that was WWII. Before that and moving backwards in time, it was Roosevelt’s recession in 1937 then the Great Depression in 1929 then the Panic of 1907 and the Panic of 1893. We’re are probably on the precipice of another great catalyst for equalization.

Spend when you need to. Spend on what you can really afford. Spend on what you truly need. Otherwise, stop spending especially when you can’t afford to and don’t need to. Every contribution helps.

Remember that when you spend to impress, those whom you’ve impressed will not be there to bail you out when the good times end. So why bother?

Weekend Food For Thought – 28 April, 2012

Just How Do Singaporeans Live?

The cost of a one bedroom apartment in Tg Katong/Paya Lebar is now S$900,000.

The cost of any small car in Singapore now comes at a minimum of $100,000. (That’s not even considering the $90K COE for a 2L car.)

You need to be a millionaire to afford a tiny house and a small car in Singapore today … or be seriously in debt to own these things.

And if you were in debt owning these things, you’ll be in serious trouble if the economy takes a small 7% hit. That doesn’t even consider your daily expenses, utilities and existing obligations. Now consider that the government is raising its monetary policy in view of tightening the value of the SGD. This is usually a signal to banks to start tightening as well. Now consider your debt when the banks start raising its rate.

If an above average Singaporean earns around S$5,000 monthly, at no interest, his monthly repayment for this $900,000 shoe box apartment will be about $2,500 for the next 30 years. His monthly repayment on his little $100,000 car over 10 years at no interest will be $830. Other monthly expenses; utilities average around $150, parking $200, petrol $300, ERP $120, …. I think I’ll stop there.

This alone works out to $4,100 which leaves $900 of his salary remaining which works out to $225 a week for other expenses.

Wait a minute, I also didn’t consider his CPF contributions and income tax deductions … and a lot more other stuff.

And we still haven’t factored in interests.

I also didn’t consider if this person was married with kids.

Things in Singapore are becoming much like West Malaysia where costs are outweighing income. The poor Malaysians have been living under worse conditions for a much longer time and the Little Red Dot is following suit.

Inflation has risen from nothing to 5.2% since 2010.

The price of housing has risen by as much as 40% since 2010.

The price of cars has risen by at least 115% since 2010.

Bread is now 50% more than in 2010.

Many other basic expenses and staples have risen so much in the last two to three years but we continue to suffer in silence and worse, abet it with our lavish spending and thoughtless investments. I really wonder how many can actually afford to spend they way they are spending. Its no wonder so many apartments were returned with the buyers defaulting on their deposits. That is just a small example of the kind of thoughtlessness I am referring to.

In the meantime, salaries have not risen by more than 5% in the last two years.

Banks are still paying out 0.nonsense% in savings interests.

And your stocks are not higher than where they were in April 2010.

We know where all this money … or should we say, debt … is coming from and we just keep mounting it higher and higher.

Now that China’s meltdown is imminent, Spain and UK are in recession, most of the manufacturing world’s PMIs are still in contraction and America’s GDP has contracted, it is only a matter of time that we will pay for our greed, pride, face and ego.

I am just praying that our elected leaders have a firewall or a plan B in place when the shit hits the fan. Coz I don’t want any of that shit to hit my face when I have been financially prudent and undeserving of any punishment as a result of other people’e thoughtlessness.

Weekend Food For Thought – 07 April, 2012

DEFENSIVE TRADING – EPILOGUE

![]() Trading and driving are alike in so many ways. And the way you drive betrays they way you will be trading. Rules of the road are set up for safety reasons just as we set up rules for ourselves when we trade. These rules keep us on the safe side of danger and lower our risk to ensure we reach our objectives without getting hurt. In a worse case scenario, we might encounter a few scrapes or bumps by we still get to our objective without killing ourselves. In life as in driving as in trading …

Trading and driving are alike in so many ways. And the way you drive betrays they way you will be trading. Rules of the road are set up for safety reasons just as we set up rules for ourselves when we trade. These rules keep us on the safe side of danger and lower our risk to ensure we reach our objectives without getting hurt. In a worse case scenario, we might encounter a few scrapes or bumps by we still get to our objective without killing ourselves. In life as in driving as in trading …

Break the rules and you’ll be punished

Make a mistake and it will be costly

Take a risk and the consequences can be tragic

![]() Besides the way I drive, my life as a trader also mirrors that of my life as a father, son, teacher, friend and businessman. I live my life as best I can. I do as many good deeds as I can with no expectations and looking for no accolades. I live prudently and frugally and live within my means. I have indulgences but they are controlled and inexcessive. I have a horrible bad habit of smoking which I do my best to keep in check and do so within the confines of the local laws.

Besides the way I drive, my life as a trader also mirrors that of my life as a father, son, teacher, friend and businessman. I live my life as best I can. I do as many good deeds as I can with no expectations and looking for no accolades. I live prudently and frugally and live within my means. I have indulgences but they are controlled and inexcessive. I have a horrible bad habit of smoking which I do my best to keep in check and do so within the confines of the local laws.

We are never perfect but we do our best to bring the best out of ourselves and shield away what we know makes us ugly. In trading, we do what we know and we do it well and we stay away from the obvious risks that we know is likely to hurt us.

I have built a family, a business, a trading and teaching career slowly and surely. I have built a reputation for myself. It was tough. There were very difficult moments. There were many challenges. Through each hurdle, mistakes were made along the way but each mistake was a lesson learnt to make me a ![]() better man, a sharper professional, an effective teacher and a more astute businessman. I worked hard to achieve these things and I now defend them with my experience. I keep working hard to lessen the mistakes, I continue to learn as I teach, I strive to always do better to improve my teaching skills and I live my life as best I can to maintain my reputation.

better man, a sharper professional, an effective teacher and a more astute businessman. I worked hard to achieve these things and I now defend them with my experience. I keep working hard to lessen the mistakes, I continue to learn as I teach, I strive to always do better to improve my teaching skills and I live my life as best I can to maintain my reputation.

![]() My life as a trader is no different. I will defend what I have earned and I will strive to continually improve on my trading skills so that I can defend better. I protect my trades no differently than how I protect my family, business and career. I am focused on keeping what is rightfully mine and I never let anything threaten what I have so lovingly and carefully built. The first line of defense in my home is me and the first line of defense in my trades is the same person with the same mindset.

My life as a trader is no different. I will defend what I have earned and I will strive to continually improve on my trading skills so that I can defend better. I protect my trades no differently than how I protect my family, business and career. I am focused on keeping what is rightfully mine and I never let anything threaten what I have so lovingly and carefully built. The first line of defense in my home is me and the first line of defense in my trades is the same person with the same mindset.

![]() In life, we make smalls steps to advance ourselves. We practice what we love to do so that we do it well. We make incremental adjustments to our lifestyle to improve our lot in life. We make small sacrifices for the sake of a bigger slice of happiness. We control our short-term greed to ensure a long term growth in our wealth and health.

In life, we make smalls steps to advance ourselves. We practice what we love to do so that we do it well. We make incremental adjustments to our lifestyle to improve our lot in life. We make small sacrifices for the sake of a bigger slice of happiness. We control our short-term greed to ensure a long term growth in our wealth and health.

![]() In trading, we are no different in that we constantly make small steps to improve our trades, we practice to gain more experience, we make adjustments to improve our trading style, we take small losses to keep our confidence so that we can grow our accounts in the long term and grow it exponentially and we do it knowing that this is who we are … in life and in trading.

In trading, we are no different in that we constantly make small steps to improve our trades, we practice to gain more experience, we make adjustments to improve our trading style, we take small losses to keep our confidence so that we can grow our accounts in the long term and grow it exponentially and we do it knowing that this is who we are … in life and in trading.

![]() All in all, the long and short of it, at the end of the day, for all intents and purposes, in trading as in life, it is all about me loving what I do and I do it all with a passion. And that is how I live my life too.

All in all, the long and short of it, at the end of the day, for all intents and purposes, in trading as in life, it is all about me loving what I do and I do it all with a passion. And that is how I live my life too.

Weekend Food For Thought – Mar 24, 2012

DEFENSIVE TRADING – LESSON 5

Over the last four weeks, we’ve looked at some of the most effective ways to avoid getting our trades into unnecessary risks including ~

Over the last four weeks, we’ve looked at some of the most effective ways to avoid getting our trades into unnecessary risks including ~

- • how we position ourselves in the market in Lesson 1,

• why losses are more important than profits in Lesson 2,

• what we can do to lower our financial risks and increase our financial gains in Lesson 3 and

• when we should or should not be trading in Lesson 4

… the “How”, “Why”, “What” and “When” to trade.

In this penultimate installment, we’ll look at the one element that puts it all together – the “Who”.

Who you really are is how you will be trading.

Your trading results reflect who you really are.

In other words, the market is going to open you up to the truth and you may not like what you see about yourself. It is because of this last lesson that I decided to take the path I took toward my trading goals.

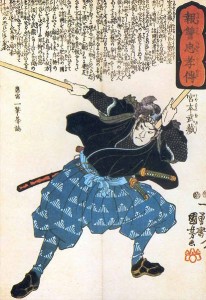

KNOWING

In 1664, legendary swordsman, Miyamoto Musashi wrote The Book of Five Rings (Go Rin No Sho) made up of five books; The Books of Earth, Fire, Water, Wind and Void. The books were about Musashi’s various thoughts and lessons on the art of war and individual combat. Today, it represents some of the finest methods used in business, sport and of course, trading. Of the five books, the Void is the shortest book but the one with the most meaningful and lasting impression for me.

The void is where nothing exists. It is about things outside man’s knowledge. Of course the void does not exist. By knowing what exists, you can know that which does not exist. That is the void.

People in this world look at things mistakenly and think that what they do not understand must be the void. This is not the true void.

It is confusion.

In the Way of strategy, also, those who study as warriors may think that whatever they cannot understand in their craft is the void. Someone like that will continue to be distracted by irrelevant things. This is not the true void.

To attain the Way of strategy as a warrior you must study fully other martial arts and not deviate even a little from the Way of the warrior. With your spirit settled on your duty, you must practice day by day, and hour by hour. Polish the twofold spirit of Shin [heart] and I [will], and sharpen the twofold gaze of ken [perception] and kan [intuition]. When your spirit is not in the least confused, when the clouds of bewilderment are cleared away, there is the true void.

Until you realize the true Way, whether in religious or in worldly laws, you may think that your own way is the one correct and in order. However, if we look at things objectively, in the light of the Straight Way of the Heart or in accordance with the Great Square of the World, we see various doctrines departing from the true Way.

What you believe in often proves to be contrary to the true way, distorted as it is by tendencies to favor your own thoughts and views. Know this well and act with forthrightness as the foundation and keep the true Heart as the Way. Enact strategy broadly, correctly and openly.

Then you will come to see things in an all-encompassing sense and taking the void as the Way, you will see the Way as void.

~ Miyamoto Musashi

Read that whole script again. This time, void your mind of any thoughts and read it as a trader. Replace “warrior” with “trader” and you will see why this meant so much to me.

LEARNING

Having read so much and having learned from so many people, my mind became clouded and influenced and so did my trades. What I had been learning were the various strategies and techniques to trade. These were the “irrelevant things” Musashi was talking about. I kept thinking that I was missing something and that something would be the secret to my trading success. I kept looking at that “void” which was not the true void.

It wasn’t until an obvious fact hit me that I realized that I had been doing everything from the wrong approach.

What you believe in often proves to be contrary to the true way, distorted as it is by tendencies to favor your own thoughts and views.

I had been learning and adopting methods and strategies from gurus whom I had foolishly believed to be successful traders when they were nothing more than businessmen who made money from selling seminars. I was gullible enough to believe that I could become as good as the best in only three days of “education”, when the best are those you find in Wall Street who have spent three to four years in the finest universities to learn their craft and spent another three to four years in mentor-ship in some of the greatest financial institutions in the world to hone their skills.

So what I had learn and believe to be the way was in fact contrary to the true way and distorted by my tendency to favor my own thoughts and views.

… you must study fully other martial arts and not deviate even a little from the Way of the warrior.

It is necessary to learn everything. And this meant that I had to learn what the Wall Street trader learnt and know what he knows and do what he does. Without going into a very long drawn and detailed account of what I did and how I did it, let me just say that it was an eye opening experience and one that made me feel so foolish and gullible for believing that a three day workshop could have made me as good as the Wall Street warrior.

In Musashi’s day, this would have been akin to me taking a weekend workshop on sword wielding by some self-proclaimed Samurai and believing that I could have taken down Musashi after that crash course. I would have been psychologically unprepared, unskilled and too inexperienced to have taken on even one of Musashi’s junior students, let alone the man himself. I would have been killed on the first stroke of his bokken and he wouldn’t even have drawn his Katana.

Thus, in spite emptying out all that I thought I knew and relearning everything that a Wall Street warrior knows, knowledge alone was never going to be enough.

APPLYING (TAKING ACTION)

In battle, it is often said that wars are won or lost even before the first shot is fired. This implies that the mindset and psychology of the generals and soldiers were foremost in achieving success. We know from history that the victors were always the side that was motivated, disciplined and hungry. The vanquished were always the ones that lacked discipline, self-esteem and courage.

Technology never always secured victory as was the case with the Germans in WWII. The machines were only as good as the men who used them. Toward the end of WWII, the Germans had far superior weapons than the allies yet they failed to regain any sort of superiority as the men who operated the machines were hastily and ill trained and certainly resigned to failure and eventual surrender. They had lost all motivation to fight.

Taking this lesson from history, I recalled Musashi’s text and practiced in all earnestness.

… you must practice day by day, and hour by hour …

I focused on becoming a disciplined exponent of my craft. I became passionate about what I did and thus was naturally motivated in my intentions. I focused on specializing and picked a handful of securities at which I chose to excel in. The idea came from a simple fact – in any profession, a true professional always has a specialized skill and is never a Jack-of-all-trades. After mastering his skill, the professional then goes on to learn other skills and masters each one, one by one, slowly and steadily.

Traders on the floor of an exchange also specialize. They know everything there is to know about the markets and will use all that information to help them in their specialty trade. They draw conclusions by looking across all the various instruments such as bonds, currencies, commodities and equities. They use macroeconomics as their indicators and fundamentals as their defense. They feel the pulse of the economy and are always in the know of where the smart money is flowing. They are always more than a step ahead of everybody else.

Then I realized that to become like the Wall Street trader, the skill and knowledge was only the tip of the ice berg.

… Polish the twofold spirit of Shin [heart] and I [will], and sharpen the twofold gaze of ken [perception] and kan [intuition] …

The skill alone was never going to be enough without the right psychology. I practiced to master the Shin (heart) and I (will) and sharpened by Ken (perception) and Kan (intuition).

True heroic warriors went into the battle with no fear of death and were able to perform at the highest level of stress and pressure and emerge victorious. Their business was the business of life and death. There was no room for doubt and no space for fear. There were no allowances for mistakes and the price of a lapse in concentration, discipline or confidence would have cost him his life. He had to know the enemy, he had to understand the nature of the battlefield and he had to know the extent and limitations of his abilities, his weapons and his fellow warriors as a team. The Shogun too had his work cut out for him as he needed to be shrewd with his battle tactics, know how to use his army to full effect and also preserve the bulk of his forces. He was never going to win every battle but his focus was always to win the war.

As a trader going into the market, I cannot let myself be afraid of losses. Like the Shogun, my focus is to preserve my capital and cut my losses to live and fight another day. I am never going to win every trade but I will make my annual income. To do this, I learnt about my own weaknesses and shored up my strengths. I reduce as much risk on my trade as possible before I take the trade and I keep my discipline of financial management to keep my confidence high. I put extensive research into the trade and the market I am trading in to understand its nature and protect myself from the risks. I stay focused on what I am doing to avoid mistakes and I am aware of the tactics available to me so that I can maximize my time in the market to optimize the duration of my trade. I do not wish to stay in the fight for longer than I have planned so that I do not over extend myself and lose my edge. I never over-commit myself by over-trading and I never let my losses lose more than I will allow.

Know this well and act with forthrightness as the foundation and keep the true Heart as the Way. Enact strategy broadly, correctly and openly.

Then you will come to see things in an all-encompassing sense and taking the void as the Way, you will see the Way as void.

THE OUTCOME

Needless to say, it took a long time to get to the minimum level of expertise that I sought – much longer than any book, guru or workshop said it would and it definitely didn’t happen overnight as I was led to naively believe when I started.

It took the right attitude, the correct mindset, lots of hard work, much patience, hours upon hours of practice, astute psychological management, strict discipline, financial management and continued learning to get me to where I am. This is how the Wall Street trader did it too. There is no short cut to success in any business and definitely not in this business.

Isn’t it strange that no other profession has gurus conducting three day workshops? You’ll never get a crash course in surgery, there are no weekend workshops for law or accountancy and certainly no seminars for architecture and engineering. But you will get plenty of workshops and seminars about trading and they always make it sound so easy and achievable.

And the results of such workshops are obvious for all to see. There are always a few initial successes but these few never last for long. In most cases, more than 85% of the time, there are losers.

If you have been losing on your trades, then it is obvious that what you have learnt is not the way and you are confused. In order to achieve success, you will have to clear your mind and start all over again as I did and learn the way of the true successful practitioner.

Thus, if ..

Your trading results reflect who you really are

… and you have been losing, then who you are is very obvious.

I think it is time for change.

Weekend Food For Thought – Mar 16, 2012

Trade because you have a trade.

Never trade because you have to trade.

That simply means that if you don’t have anything to trade, don’t trade anything. It also means that you should only trade when there is an opportunity for a low risk trade. What it mostly means is that you shouldn’t be trading anything for the sake of trading something especially when there is nothing to trade.

In order to do that, about the only way to know if you do have a trade is to look at your charts. This is when we become over-dependent on our charts and start looking for ways to get “the edge” over the market.

And this is when everything starts to fall apart.

Too many times, traders don’t let the charts tell them what it wants to tell them. Instead, traders see only what they want to see or hope that what they see is what will happen. In many cases, traders allow themselves to get lulled into indications that the market might make a move.

They use things like MACD, Stochastics, RSI and a whole bunch of exotic indicators with all sorts of permutations to find that “edge”.

Common sense will tell you that there is no such “edge” … there hasn’t been such an edge for centuries. All you have to do is ask yourself a simple question and you will see how silly it is to go looking for that edge;

“How did the traders in the 50s and 60s trade without computer technology?“

Here’s another dumbfounding question;

“How did the Japanese do it 400 years ago when communication was only as fast as the horse (denma) could run?“

For years and years, traders have looked for that holy grail, that magic formula and that all-winning strategy. Many experimented with different styles, technology and strategies. Their results were always the same – they ended up nowhere and their accounts dwindled. Meanwhile, the ardent and conventional traders went on to make their money the old fashioned way using risk management, financial management and psychological management – all the three defensive arms of a successful trader.

It is hard work. It does take a lot of practice and it definitely takes a lot of experience. There is no easy way to do this and there is no short-cut to this success. All a trader can do is to use his experience and skill to know when to take a trade because there is something to trade. He will never know if the trade will work out but he has eliminated all the major risks before considering this position. If there is too much risk, then there is nothing to trade.

There never was and never will be a way to know what the market will do next or which direction it is going to take. It will swing back and forth regardless of macroeconomic influence, historical tradition and mathematical probabilities. One can never fully factor in all the possibilities because the market is made up of the widest myriad of players;

Some are pros who stay rational, others are novices who are irrational, some are long term players that hardly react and others are short term traders who over react.

Then you have those who are experienced and savvy versus many others who don’t know what they are doing, some who second guess the market and predict it against those who stay with the trend.

Then you have those who will swear by fundamentals in the long term and those who only use technicals in the short term

So how can any one system or method or indicator or technique or strategy fully take in all the amazing dynamics that the market has to offer? How can a trader find an “edge” to beat the odds? What can he possibly see in the charts that will tell him for certain what the future holds?

The greatest traders that ever lived could never answer that question and the great ones who still live still can’t answer it.

Then comes the second mistake – When we don’t have a trade, we go looking for a trade.

Traders will use software or screeners to “find the best trade” without using common sense because common sense will tell you that the “best trade” is the one that has already happened. Chances are, you’re already too late. No screener or software is going to tell you which trade is going to be the best.

The best software available is the one that will shortlist the lowest risk trade. That is as good as it gets. But that software is base, without doubt, on a mathematical probability. Any software for that matter is based on math. And common sense tells you that the market is not a mathematical place – it is highly emotional. No math on earth can calculate the human emotion or what the next emotion will be. To put the case beyond any reasonable doubt, no math can calculate the most common emotion in the market – irrational behavior.

The long and short of it is that it takes hard work, patience and lots of practice to gain the experience needed to be a successful trader. And the reason why there are so many more losers than winners in the market is simply because the few winners are the ones who have done what the many hate to do – work hard, be patient and practice. That is the only way to get the experience needed to succeed. Experience takes time and time cannot be rushed.

The few winners are the ones who specialize and use their vast experience to trade what they know too well. They don’t have to scour the whole market to find the best trade because the best trade is the one they do everyday. On days when their specialty is not favorable, they don’t trade. On certain days when the risk is lower, they take the trade. Thus,

Never trade because you have to trade.

Only trade when you do have a trade.

The only edge you can have will be illegal and its called “Insider Trading”. But we won’t go there.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Comments are moderated so Spammers, please don’t waste your time. Get a life and get a real job.

Weekend Food For Thought – Mar 09, 2012

DEFENSIVE TRADING – LESSON 3

Never add more risk to higher risk.

The first thing you will say when you read that is, “I know that.” But do you really know? So many people I have met know this but still don’t practice it. In fact, they do exactly the opposite.

In 2008, 60 Billionaires in China were reduced to just 20 in a matter of months. The reason for their demise was a simple lack of risk management married to terrible financial management. They added more risk to their already high risk positions and when things went wrong, it only exacerbated their losses.

“Higher risk” in this case refers to a stock that has already made multiple highs. It looks tempting. It gives you a sense of urgency. It shows you that the next resistance up is going to give you a 30% profit from the current price. But you already hold 1,000 shares of it or maybe you don’t and you want to buy in now.

Doesn’t this look so tempting especially if I told you that this stock can get up to $240 and that it has never missed an earnings call and that analysts have been raving about this since August and that Soros and Paulsen are claiming that this stock is better than AAPL and that Warren Buffet just bought $100M worth of this stock at $80 with a long term view for $280?

Now let’s put you in the trade at $40 at the start of August. As the trade goes up to $60, you would want to buy more especially if you read that Soros and Paulsen love this stock. So as the story goes …

So you buy more as the trade rises. With a budget of 15,000 shares, you start your investment with some reservation but as the trade starts looking better, you increase your position sizing as the trade rises. At the high of $135, your accumulated unrealized profit stands at an amazing $625,000.

- 1,000 Shares X $95 profit = $95,000

- 2,000 Shares X $75 profit = $150,000

- 3,000 Shares X $55 profit = $165,000

- 4,000 Shares X $35 profit = $140,000

- 5,000 Shares X $15 profit = $75,000

Now, that is a lot of money. Congratulations. Let’s hope it doesn’t make a nasty correction.

But it does. It always happens.

Initially, you will wait and see if the $110 support will hold and reverse with the Hammer. But in the next two sessions, things go terribly wrong – the stock slices through the $110 and $100 supports and then makes a nasty drop to an intra-day low of $70.

You can’t stand it anymore and you cut loss. Another possibility is that you get a margin call and your trade is frozen.

Now let’s see what your account looks like …

- 1,000 Shares X $30 = $30,000

- 2,000 Shares X $10 = $20,000

- 3,000 Shares X ($10) = ($30,000)

- 4,000 Shares X ($30) = ($120,000)

- 5,000 Shares X ($50) = ($250,000)

Thus, a cut loss or margin call at $70 (last retracement candle low) will give you a net loss of ($350,000).

Let’s just say, for the sake of argument, that you are a disciplined trader and you cut loss at the $95 resistance or that your broker margin called you at $95 …

Your accounts will look better but you’re still copping a loss …

- 1,000 Shares X $55 = $55,000

- 2,000 Shares X $35 = $70,000

- 3,000 Shares X $15 = $45,000

- 4,000 Shares X ($5) = ($20,000)

- 5,000 Shares X ($25) = ($125,000)

Even a cut loss or margin call at $95 (second-last retracement candle low) will give you a net loss of ($25,000).

This is what happens when you add more risk to a trade that is already risky. Any trade at a historical or 52 week or multi-year high is regarded as risky, regardless of what analysts and experts say about it. Remember that these are the crooks that need to drive the stock up so that they can scalp the suckers who buy in way after they bought the stock at $30.

Knowing that the stock is not able to sustain the run, they sell and the stock dips, When they have nothing left to sell and they know that there is still a huge inventory of long stocks remaining, they short the stock. The fools that bought in at and near the high will panic and sell which helps to bring the stock down even faster.

So just how do you make money from a trade like this without adding more risk to higher risk? Simple; add less risk!

It’s call my

Pyramid System Of Financial Management.

Take a good look at the Money Pyramid – the base is wider than the top. So maybe the Egyptians of 4,000 years ago knew something that we today still don’t … it’s called Preservation.

The Pyramids were tombs whose shape was critical in helping to preserve the bodies of the mummies within its structure. This was proven in several experiments featured on Discovery Channel’s “Myth Busters” and National Geographic’s documentaries on the secrets of the Pyramids’ Powers of Preservation.

So let’s see if the Pyramid can preserve our capital and/or profits the same way it preserved its mummies.

Let’s take the same trade again and let’s be defensive about it this time. We’ll use my Pyramid System Of Financial Management to defend ourselves and preserve our trade capital and profits. We’ll use the same capital and buy points as the previous trade. But since the Pyramid’s base is wider than the top, let’s this time invest half of our capital in the trade to start with and then buy less as the trade runs up and gets riskier …

As in the previous instance, the stock makes that nasty drop and we again depend on the $110 support to hold and reverse with the Hammer. But in the next two sessions, things go terribly wrong – the stock slices through the $110 and $100 supports and then makes a nasty drop to an intra-day low of $70.

We cut loss …

Now let’s square up out accounts …

- 5,000 Shares X $30 = $150,000

- 4,000 Shares X $10 = $40,000

- 3,000 Shares X ($10) = ($30,000)

- 2,000 Shares X ($30) = ($60,000)

- 1,000 Shares X ($50) = ($50,000)

Thus, a cut loss at $70 (last retracement candle low) will still leave you a net profit of $50,000.

Let’s see what happens to the disciplined trader who cut loss at the $95 resistance …

Once again, let’s square up our accounts …

- 5,000 Shares X $55 = $275,000

- 4,000 Shares X $35 = $140,000

- 3,000 Shares X $15 = $45,000

- 2,000 Shares X ($5) = ($10,000)

- 1,000 Shares X ($25) = ($25,000)

A disciplined cut loss or margin call at $95 (second-last retracement candle low) will leave you a healthy net profit of $425,000.

Now how does that grab you?

Here’s the really sweet part of the Pyramid System Of Financial Management – it can be used for averaging down, profit taking, risk reduction, position sizing and a whole lot more other fantastic ways to help you reduce your risk and preserve your capital. And it is a system that you can use in life, business and basically anything that involves your money and risk.

But that is a lesson I save for my tutorial students! *wink!*

At least you have this one lesson that will stand you in good stead the next time you want to add to your positions. In a worst case scenario, at least you won’t end up with the kind of Pyramid the Chinese Billionaires used in 2008!

Happy Hunting and Safe Defensive Trading Always!

Weekend Food For Thought – Mar 03, 2012

DEFENSIVE TRADING – LESSON 2

The market will give you what it wants

and it will take what it wants

And that is why I don’t bother with profits and instead place my focus on losses.

The market will give you whatever it feels like giving you. On a generous day, it’ll give you more than you bargained for. On other days, it’ll be stingy. One fact remains – you have no control over how much you can make.

The market will also help itself to what ever it wants from you. On a nasty day, it can wipe out your whole investment. On merciful days, the punishment is more tolerable. In this, another fact prevails – you do have control over how much you want to lose.

And that is why I don’t bother with profits and instead place my focus on losses. If I can’t control how much I make, then I might as well focus on how much I lose and make sure that I don’t lose more than I set out to lose before I took the trade. I always budget my trades. But contrary to what you might think, I don’t budget how much I lay out as a capital as much as budget how much of that capital I am willing to lose. And I never lose more than what I had budgeted to lose. This keeps me confident and keeps my account healthy.

Its very much like race driving. Novices prefer to know how fast the car can go but professional racers know how long it will take to bring the car to a stop safely.

Cut your losses early

and let your profits run.

Take a good look at that sentence and make sense of it.

Now ask yourself; where in that sentence does it imply that you can or should control your profits? It instead tells you that you should control your losses because you can. And since you have no control over your profits, allow it to run for as far as it will go.

It is your losses that you should keep consistent. Keep it consistently small because you will never know how much you will make in the next trade. This is why I insist that the profitable trader is the one who knows how to lose consistently.

Yet you will get gurus who will tell you things that only serve to conflict with your subconscious mind. They will confuse the hell out of your trading psychology in one mind-bogling sentence –

“Make consistent profits by cutting your losses early and letting your profits run.”

Read that carefully. If you don’t find that conflicting or confusing by now, you haven’t learnt anything here.

I much prefer to use the original Japanese version …

Lose as little as you can

and make as much as is allowed.

People often ask me what it takes to become part of the winning percentage. You see, it is widely accepted that the losers make up 90% of the market while the winners are the few 10% that make all that money that the 90% loses … and it is a lot of money.

My answer is a basic and slightly different take on the question;

If you don’t want to be part of the 90%, then don’t lose. If you don’t lose, you are likely to win. Even a small win puts you in the 10%.

And that is why I don’t bother with profits and instead place my focus on losses.

Happy Hunting!

Weekend Food For Thought – Feb 24, 2012

People often ask me what I mean by “trading defensively“. That is a very simple question with a huge base of answers of which some are really common sense stuff that we do in our every day lives. So starting this weekend, I will be delivering a series of five lessons on what I do as a Defensive Trader and why I choose to trade this way.

DEFENSIVE TRADING – LESSON 1

When I first started trading, I had picked up all the wrong things that I thought trading was about. A fair amount of stuff were from books and gurus. And almost all the things I picked up were based on the American Trader’s way of doing things – gung ho. They were all attacked minded stuff meant to hype you up and drive you into the market head-first and with guns blazing. Maybe it was the way they taught, maybe it was the way I perceived it or maybe it was true. Whatever it was, one thing was certain – it wasn’t working for me.

To cut a long story short, I looked east instead to find another way of doing this. And I found Japan. I had no idea at that time how deeply steeped Japan was in the culture of trading. And to cut that long story short, it came down to one man who made all the difference in the way I trade today. His name is Homma Munehisa.

Homma Munehisa (Honma Munehisa, 1724-1803) was a rice trader around 260 years ago in Sakata, Japan during the Tokugawa Shogunate (Tokugawa jidai) in the Edo Era (Edo jidai). He traded at the Ojima Rice market in Osaka and is widely accepted as the father of the candlestick charting analysis. He was a legendary trader with many accolades to his name including being honored as an Honorary Samurai for his trading prowess and for his contributions to the advancement of the art of trading.

Homma Munehisa (Honma Munehisa, 1724-1803) was a rice trader around 260 years ago in Sakata, Japan during the Tokugawa Shogunate (Tokugawa jidai) in the Edo Era (Edo jidai). He traded at the Ojima Rice market in Osaka and is widely accepted as the father of the candlestick charting analysis. He was a legendary trader with many accolades to his name including being honored as an Honorary Samurai for his trading prowess and for his contributions to the advancement of the art of trading.

In 1755, he wrote San-en Kinsen Hiroku, The Fountain of Gold – The Three Monkey Record of Money. This is one of the earliest books in history that discusses Trading Psychology as an important aspect of market behavior. He mentioned that a Trader’s Psychology is critical to trading success and that the Traders’ emotions have a significant influence on price movements.

Munehisa was also arguably the first to give us the two types of markets; Yang (a bull market), and Yin (a bear market).

It wasn’t Warren Buffet who first said,

Be fearful when others are greedy.

And greedy when others are fearful.

It was Munehisa who first gave us,

When all are bearish, there is cause for prices to rise.

When all are bullish, there is cause for prices to fall.

I am sure you have heard about Buying The Rumor & Selling The News. Munehisa wrote that if you get news about something that could make a profit for you, wait three days and if it still looks good, it should be a profitable trade. This was based on the extensive Sakata Method discussion from his second book, Sakata Senjyutsu Syokai – A Full Commentary on the Sakata Strategy. A lot of this methodology employs the number Three as its basis; Three Crows (Bearish Reversal), Three Soldiers (Bullish Reversal), Three Methods (Continuation), Three Buddhas (Head & Shoulders), Three Mountains (Triple Top), Three Rivers (Triple Bottom) and Three Gaps.

A lot of what we read today have their roots in the books that Munehisa wrote.

In his third book, Homma Sokyu Soba Zanmai Den, written as Honma Sokyu – Tales of a Life Immersed in the Market, Munehisa shares his methods and techniques that made him a legend. His conservative manner and the defensive attitude he took into the market made him the finest trader to have walked the earth. His humility and the respect he gave the market made him one of the most profitable traders of all time.

But the beauty in the way he wrote it all was lost in translation when the west got hold of his philosophies and turned it into something more aggressive and offensive. And it was this rubbish that was taught to me and this nonsense that I was reading off books.

Having discovered this 250 year old approach to trading has made all the difference in the way I trade, teach and live.

I found that the Japanese way of trading suited me better as an Asian who is conservative and defensive by nature, by upbringing and by education. It was easier to grasp the concepts and methods as they were more natural to me rather than the gung-ho style that had been forced down my throat. The Japanese style of trading employs Three Choices rather than the do-or-die choices that the west teaches.

In the west, we learn,

Buy Low, Sell High

That is pretty much a do-or-die choice without any room for much else. Munehisa advocates that you should;

Never Buy The High.

And Never Sell The Low.

That allows you two out of three choices;

Never Buy The High tells you that you can sell if the price is at a high or you can hold if the price is high but you should never buy because the price is high. This gives your psychology a chance to choose and greatly reduces your risk of doing the wrong thing. And the wrong thing is buying things when the price is high – don’t we always look for discounts when we shop?

Never Sell The Low tells you that you can buy if the price is at a low or you can hold if the price is low but you should never sell or short-sell because the price is already at a low. The wrong thing to do is to sell when the price is low – don’t we always look for the highest bidder when we sell? (think property.)

That was just the tip of the Defensive iceberg.

In the next four lessons, I will share more defensive ways to go about your business and help you to stop losing money to the market as a result of doing stupid things that are not natural. Many of your beliefs and dependencies are going to go up in smoke or blow up in your face when you realize the simplicity, efficiency and beauty of the Japanese Defensive Methodology that I employ today.

Till next week, have a good weekend and Happy Hunting Always.

Weekend Food For Thought – Feb 11, 2012

This week’s thought comes from my reply to someone who asked me something about the market in a way that most people would ask – as if Traders knew the future …

Conrad,

where do you see the economy heading? …

what do you think the market is going to do? …

is XXX a good buy now? …

will the property market collapse? ...”

Many people have this perception that I am some Visionary, Guru or Master … I am not. I am just a trader, some say a really good trader. That is all I am. In their wrong perception of who I am and what I do, they get the notion that I am able to tell what the market is going to do or which stock is going to make the next move.

I don’t. Like everyone else, I can’t see the future.

I can’t know if the market has priced in the worse because I don’t know what the worse will be or was supposed to be. In our business, there is so much noise, manipulation, crime, lies and underhanded dealings that one can never know if something is going to bubble over or pop in our faces tomorrow.

All I do is analyze and form an opinion. It is all analyses based on numbers, statistics, patterns and a good sense of market behavior so that I can form an opinion and bet on that opinion. If it pans out, I make money. If it doesn’t, I cut my losses quickly. That is what I do for a living – calculate risk. I’ll bet on a small risk and avoid the bigger risks. Its common sense.

But how I remove risk is a complex and long drawn process. People think I make easy money but most don’t know how hard I have to work for my money. My students all know this because this is what I teach them.

We just take our positions and prepare for the worse if it should happen. We protect ourselves in many ways like hedging, stops, position sizing, budgeting and financial management.

More than 70% of the time, those bets are profitable. But when they are not, I cut the losers out very quickly without question, hesitation or reservation … now that takes practice and training … lots of practice and training so that discipline is instilled and execution can be meted without emotion.

In some cases, I don’t cut out the loser but instead, hedge against it. Now that takes experience. Experience takes time … a long time with lots of practice and training etc, etc, etc … and you cannot rush the training or the practice because you cannot rush time therefore you cannot rush experience.

Trading is a SKILL. It requires Knowledge, Application, Mentoring and Effort. Learn. Train. Practice. Work Hard. There is no other way.

If there was an easier way to make money, I would love to be the first to know about it so that I won’t have to work so hard. If there was a get-rich-quick way to get rich quicker than what I am doing now, I truly would love to know how.

I hope this sheds some light. Trading is not what a lot of people think it is. Serious trading as what I do as a profession is more taxing than anything I have ever done in my life (and it has been a tough life) and requires a lot more discipline and control than most would care to imagine.

Have a Great Weekend everybody!